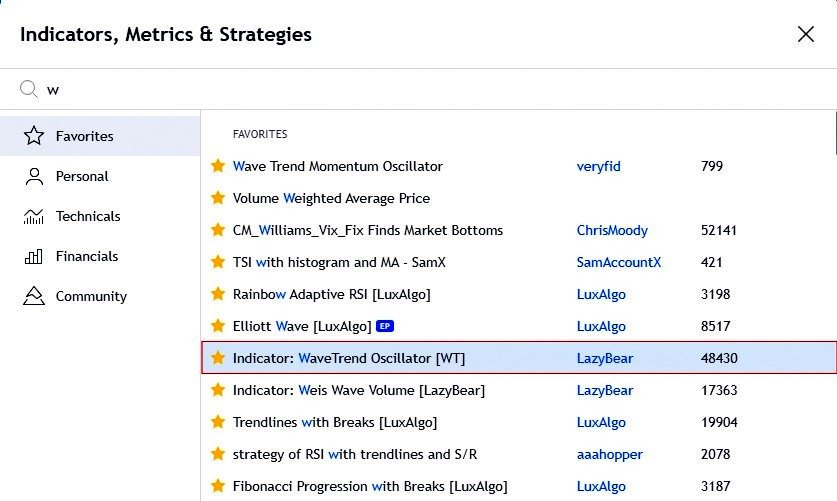

Purpose and Functionality

The WaveTrend oscillator aims to center the trend wave showing how the trend moves. It does more than just give buy and sell signals – it also points out which way the trend is going making it a useful tool. The chart has overbought zones too, which adds another way to analyze things.

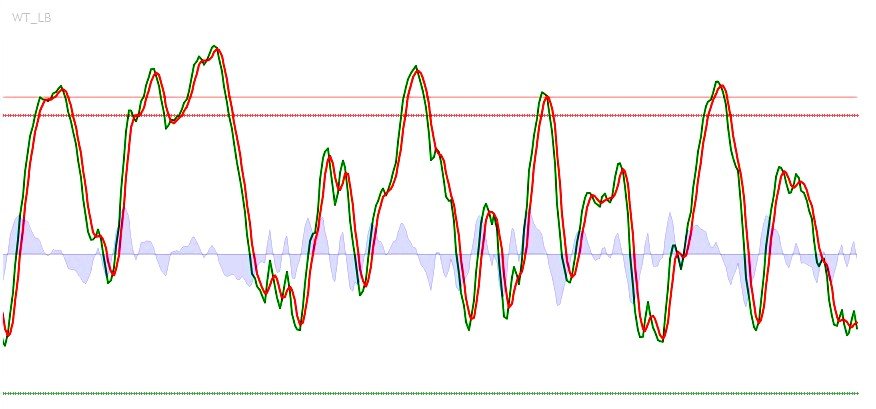

Visual Appearance

The WaveTrend indicator shows a full chart with several parts:

- Overbought-Sold Lines: Two lines at the bottom and two at the top.

- Clouds (Histogram): Sit in the middle.

- Value Lines: Two lines that move above the clouds.

These parts combine to create the indicator’s full visual display.

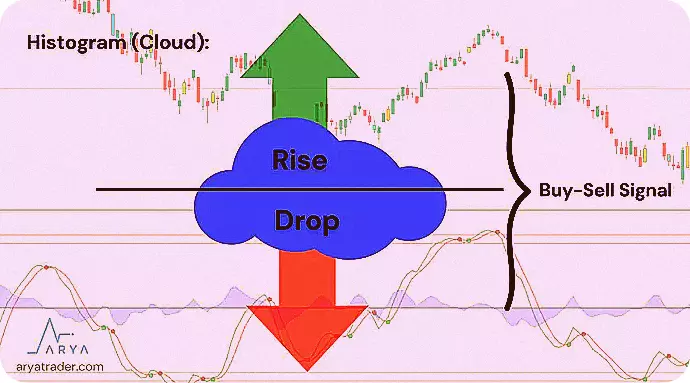

Chart Components

The indicator shows up on the chart with two value lines and a cloud wave on the midline. The cloud wave points out upward and downward trends:

- Below the Midline: Shows a fall.

- Above the Midline: Shows a rise.

These clouds play a key role to draw important buy-sell conclusions.

Generating Signals

WaveTrend produces buy and sell signals when two lines interact:

- Buy Signal: The green line moves above the red line often followed by a price increase, except during conflict periods.

- Sell Signal: The green line drops below the red line suggesting a possible price decline.

Green and red points near where the lines cross show these signals.

How to Use WaveTrend

- Trading Points: Green and red dots show buy and sell points.

- Price Candle Colors: Yellow means buy signals and turquoise means sell signals.

To use the WaveTrend indicator well:

For the best results, trade in 12-hour or 1-day timeframes. Trading in shorter periods might create too many signals leading to wrong trades.

WaveTrend Divergence

WaveTrend, like other momentum indicators, can show a gap between price and oscillator movements:

- Regular Bearish Divergence: Prices reach new highs while the indicator stays level leading to a drop in price.

- Regular Bullish Divergence: The indicator forms a higher low while prices bottom out causing a rise in price.

Using WaveTrend with Other Indicators

WaveTrend, or any single indicator, can’t give accurate results on its own. Using multiple indicators or doing a combined analysis produces better outcomes. Traders often use these indicators alongside WaveTrend:

- WMA (Weighted Moving Average)

- CMF (Chaikin Money Flow)

- RSI (Relative Strength Index)

- MACD (Moving Average Convergence Divergence)

Go ahead and create your own way to analyze by adding other indicators as you see fit.

FAQ’s of Crypto Airdrops:

1- What is a Crypto Airdrop?

A crypto airdrop is a distribution of free cryptocurrency tokens or coins to a large number of wallet addresses, typically as a promotional strategy by blockchain projects to increase awareness and circulation.

2- How Can I Participate in a Crypto Airdrop?

Participation often involves completing simple tasks such as following the project on social media, joining their Telegram group, registering on their website, or holding a certain amount of another cryptocurrency.

3- Are Crypto Airdrops Safe?

While many are legitimate, it’s essential to be cautious. Only engage in airdrops from reputable projects, and never share your private keys or personal information.

4- Do I Need to Pay to Receive an Airdrop?

No, legitimate airdrops are free. If an airdrop requests a payment or your private key, it is likely a scam.

5- How Do I Claim My Airdropped Tokens?

Instructions for claiming tokens vary by project, but generally, you may need to add a custom token in your wallet using the token’s contract address, symbol, and decimal. Detailed steps are usually provided by the project.

6- Why Do Projects Conduct Airdrops?

Airdrops are conducted to increase token distribution, promote the project, reward early supporters, and encourage the use of the platform or token.

7- Do i need Wallet for claim Crypto Airdrops?

Most airdrops require compatible wallets that support ERC-20 tokens (like MetaMask, MyEtherWallet) or other specific blockchain standards. Always check the project’s requirements.

8- Can Airdropped Tokens Increase in Value?

Yes, airdropped tokens can increase in value, especially if the project gains popularity and success. However, not all airdropped tokens will appreciate, so it’s essential to research each project.

9- What Should I Do After Receiving Airdropped Tokens?

After receiving the tokens, you can hold them, trade them, or use them within the project’s ecosystem. Make sure to follow the project for any updates or additional requirements.

10- Are There Any Risks Associated with Airdrops?

Potential risks include scams, phishing attempts, and the possibility of the tokens not having any value. Always verify the legitimacy of the airdrop and never provide sensitive information.

These FAQs should help educate and guide users interested in participating in crypto airdrops.

Join More Airdrop:

- Pi Network Airdrop

- AZCoiner Airdrop

- Satoshi Airdrop

- Grass Airdrop

- Athene Network Airdrop

- Celia Exchange Airdrop

- Bee Network Airdrop