Understanding Regression Trends

Regression trends are a powerful trading indicator that function similarly to parallel channels. However, the key difference lies in the presence of upper and lower bands, which are set a user-defined number of standard deviations away from a baseline. This tool is particularly useful for identifying when a price deviates significantly from its baseline.

Upper Deviation

The upper deviation parameter determines the number of standard deviations from the baseline to set the upper channel. Essentially, this defines the distance between the central baseline and the edge of the upper channel.

Lower Deviation

The lower deviation parameter sets the number of standard deviations from the baseline to establish the lower channel. This sets the distance between the central baseline and the edge of the lower channel.

Use Upper Deviation

This option toggles the use and visibility of the upper channel, allowing traders to choose whether to display it on their chart.

Use Lower Deviation

Similar to the upper deviation, this option toggles the use and visibility of the lower channel, enabling traders to decide if it should be displayed.

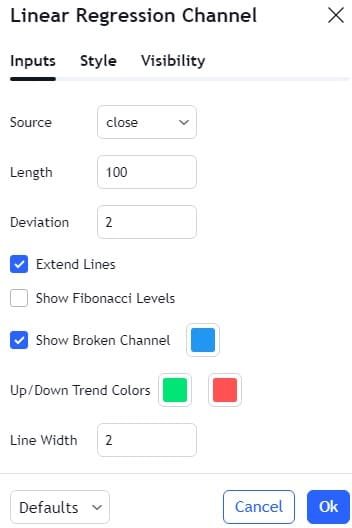

Source

The source setting specifies the price data used to calculate the channel’s position, ensuring the indicator is aligned with the selected price point.

Style Customization

The style property dialog offers extensive customization options for the appearance of a regression trend:

Base

This setting allows you to adjust the color, thickness, and line style of the baseline and the background of the lower channel. A checkbox enables or disables the visibility of the baseline.

Up

This option customizes the color, thickness, and line style of the upper channel, including the border’s thickness and style. A checkbox toggles the visibility of the upper channel.

Down

Similar to the upper channel, this setting adjusts the color, thickness, and line style of the lower channel and its border. A checkbox controls the visibility of the lower channel.

Pearson’s R

The Pearson’s R checkbox toggles the visibility of the Pearson’s correlation coefficient text, which indicates the correlation value between the two points of the regression trend.

Extend Lines

This option allows the channel lines to be extended indefinitely to the right, even beyond the current chart view, providing a broader perspective.

Precise Positioning with Coordinates

In the coordinates properties dialog, you can set the exact position of the regression trend’s points on the time axis by specifying the bar number:

Point 1 Bar

This setting allows for precise placement of the regression trend’s first point using a bar number.

Point 2 Bar

Similarly, this setting allows for the precise placement of the regression trend’s second point using a bar number.

Visibility Across Timeframes

The visibility properties dialog enables you to control the display of the regression trend on charts of different timeframes, ensuring you can analyze trends across various periods.

By mastering the Linear Regression Channel Indicator, traders can enhance their technical analysis toolkit, making more informed decisions based on precise trend data.

FAQ’s of Crypto Airdrops:

1- What is a Crypto Airdrop?

A crypto airdrop is a distribution of free cryptocurrency tokens or coins to a large number of wallet addresses, typically as a promotional strategy by blockchain projects to increase awareness and circulation.

2- How Can I Participate in a Crypto Airdrop?

Participation often involves completing simple tasks such as following the project on social media, joining their Telegram group, registering on their website, or holding a certain amount of another cryptocurrency.

3- Are Crypto Airdrops Safe?

While many are legitimate, it’s essential to be cautious. Only engage in airdrops from reputable projects, and never share your private keys or personal information.

4- Do I Need to Pay to Receive an Airdrop?

No, legitimate airdrops are free. If an airdrop requests a payment or your private key, it is likely a scam.

5- How Do I Claim My Airdropped Tokens?

Instructions for claiming tokens vary by project, but generally, you may need to add a custom token in your wallet using the token’s contract address, symbol, and decimal. Detailed steps are usually provided by the project.

6- Why Do Projects Conduct Airdrops?

Airdrops are conducted to increase token distribution, promote the project, reward early supporters, and encourage the use of the platform or token.

7- Do i need Wallet for claim Crypto Airdrops?

Most airdrops require compatible wallets that support ERC-20 tokens (like MetaMask, MyEtherWallet) or other specific blockchain standards. Always check the project’s requirements.

8- Can Airdropped Tokens Increase in Value?

Yes, airdropped tokens can increase in value, especially if the project gains popularity and success. However, not all airdropped tokens will appreciate, so it’s essential to research each project.

9- What Should I Do After Receiving Airdropped Tokens?

After receiving the tokens, you can hold them, trade them, or use them within the project’s ecosystem. Make sure to follow the project for any updates or additional requirements.

10- Are There Any Risks Associated with Airdrops?

Potential risks include scams, phishing attempts, and the possibility of the tokens not having any value. Always verify the legitimacy of the airdrop and never provide sensitive information.

These FAQs should help educate and guide users interested in participating in crypto airdrops.

Join More Airdrop:

- Pi Network Airdrop

- AZCoiner Airdrop

- Satoshi Airdrop

- Grass Airdrop

- Athene Network Airdrop

- Celia Exchange Airdrop

- Bee Network Airdrop