Introduction to AI and Cryptocurrency

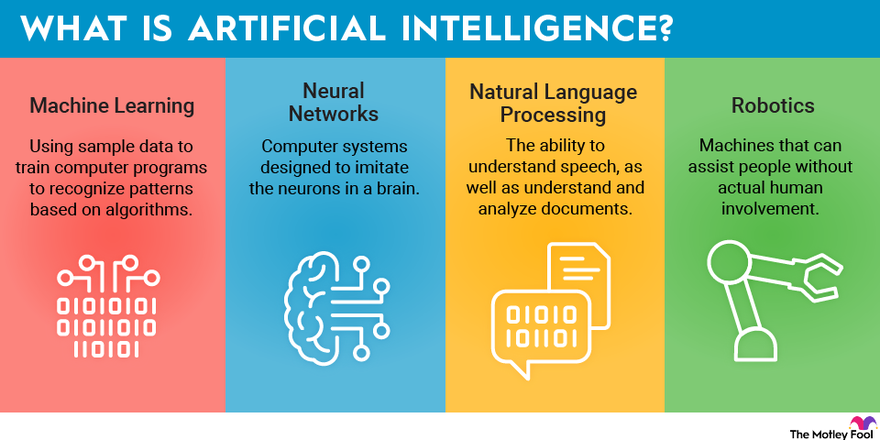

Artificial Intelligence (AI) stands out as one of the most cutting-edge fields in information technology today, with machine learning as its main driver. This breakthrough has spread to many industries, including the booming cryptocurrency sector. We’ll soon see AI become a part of trading processes and lead to the creation of smart tokens. This article looks at how AI affects the cryptocurrency market, what good it might bring, and what hurdles we need to overcome to use it.

Key Takeaways

- AI technology has an influence on crypto security, makes the trading process more effective, and boosts the mining process.

- AI has an impact on the crypto market by making mining better, strengthening blockchain security, improving smart contracts, and creating better market prediction tools.

- When AI and blockchain work together, they aim to make technologies better at spotting fishy activity and stopping illegal actions in the crypto world.

Cryptocurrencies and AI: A New Stage in FinTech

Blockchain and AI stand out as two key tech trends today. While distinct, combining them brings big advantages. PwC expects AI to add $15.7 trillion to the world economy by 2030 boosting global GDP by 14%. Gartner predicts blockchain tech will create $3.1 trillion in business value by that same year.

Both techs have their challenges but can work together to boost data use and system design. AI has the potential to make blockchain more efficient leading to more energy-saving and secure distributed ledgers. Also, AI can help companies shape their blockchain answers for specific jobs.

AI in Cryptocurrency Trading

AI has a big influence on crypto trading. It’s not just about automatic trading and guessing prices. AI can help manage risks and make trading portfolios better. AI systems can spot fraud and keep an eye on market shifts making them great tools to handle risk. AI formulas can also fine-tune crypto portfolios based on what you want to invest in and how much risk you’re okay with.

How AI Affects the Crypto Market

Predicting the Market

AI formulas will let us make exact market guesses. They’ll look at tons of info, like news and online chats, to forecast trends for any crypto asset with high accuracy.

Trading on Its Own

AI will boost math-based trading. It’ll improve the math models leading to more balanced trading plans for different levels of risk.

Crypto Safety Answers

Combining AI with blockchain has an impact on strengthening defenses against online crime and scams. AI spots shady activities, boosts identity management, streamlines KYC steps, and examines data to stop fake transactions.

Smart Contracts

AI ensures error-free smart contracts by automating debugging, fixing issues, and checking formal correctness.

Mining Development

AI improves mining by cutting down resource use and speeding up mining through better calculation models and methods.

Data Analysis

AI boosts trading by fine-tuning market studies building event scenarios, and picking the best trading plans based on mood indicators, which cuts down on losing trades.

Challenges in Using AI in the Crypto Market

Lack of Data

The crypto market is new and not well-studied. It lacks enough data to build good AI models that predict market changes and improve trading plans.

Human Limitations

Current crypto trading tools have human biases and limits. This holds back the full power of AI to speed up growth and make things modern.

Computing Power

AI needs a lot of computing power to study past data and make trading plans better. To keep AI running well, you need high-end gear and tools to keep it up.

Public Trust

Even though AI looks promising, people don’t trust it much. This stops many from using it. To get people to trust AI, we need to show how it helps in the crypto world.

Can AI Change the Cryptocurrency Industry?

AI will have the biggest impact on the crypto market by making it safer. It can spot and fight off cyber attacks, which helps blockchains work better and more . As AI gets better, we’ll need rules to stop misuse and keep personal info safe, so the market stays stable and secure.

Conclusion

When blockchain and AI team up, it’ll change the crypto market in a big way. It’ll make things safer more productive, and more spread out. This teamwork will change how trading works and how the whole crypto market runs making it stronger and ready for the future.